How to get a Malta gaming license?

Oleksandr Shadura

iGaming

Publication content

Malta is one of the largest and most interesting countries for entrepreneurs if they want to start or continue their activities in the gaming sector.

The gaming revenue sector attracts significant sums to the country’s coffers – in 2022 Malta attracted 573 million euros in taxes from licensees. Although the amount may not seem very significant, it represents 8% of Malta’s total GDP.

Territory

Malta is a relatively small island in the middle of the Mediterranean Sea. But it is not the location itself that is so important in this case, as the proximity to one of the strongest economic centers of the planet – the European Union. Malta became a member of the EU on May 1, 2004. This allowed it to embed itself in the economic system of the union, which amongst other things has 4 freedoms: freedom of movement of people, freedom of movement of services, freedom of movement of capital and freedom of movement of goods.

Malta and i-gaming

The Maltese government has set its own path of development regarding i-gaming. The legislator decided to focus specifically on regulation and transparency, ensuring a strict approach to licensing and control of gaming operations.

In this way it was possible to achieve two goals at once – to protect players and to regulate the work of operators.

A relatively recent case occurred when a lawsuit was filed against an operator who worked under a Malta license in Germany. It consisted of German players placing bets and “losing money without realizing that the Malta license had no legal basis for gambling activities in Germany”.

Consequently, the players argued that the contract with the platform was invalid and their financial losses should be reimbursed. Referring to this, the majority of German courts favored the players and granted their claims.

Seeing the situation, the Maltese government decided to protect its operators and as a result, an addition to the Malta Gambling Act was issued – Article 56A. In it the Government of Malta established that any decisions of foreign courts directed against operators with a Maltese license will be considered null and void.

The State of Malta justified this amendment on the grounds that under EU rules, a member state can refuse to recognize a judgment of another member state if it does not comply with the principles of the state’s legal system.

Additionally, the MGA stated that the scope of the Bill is “very limited” and does not stopall legal actions taken against an operator holding a Maltese license.

In this way, Malta has decided to establish a special type of defense for its operators. Very simply put, when a lawsuit is filed against an operator who operates through a Maltese license and claims to collect money or property, Malta can invalidate such a lawsuit. If the operator has no property or account in another country and everything is kept in Malta, Malta will simply not allow the claim to be honored, hence the operator’s money and property will be perfectly safe.

In the case of Maltese licensees, players are always assured that they are dealing with a jurisdiction where they will be actively protected and have access to the services and protection that this state offers.

Obtaining a license

To obtain a license you need to be a company that is registered either in Malta (preferable) or in another European Union country. Why is it better to be registered in Malta itself? It’s all about taxes (which will be clarified below).

Requirements:

- Full background check of key persons of the company and AML officer (responsible for implementation of policies to prevent money laundering and terrorist financing);

- Compliance with authorized capital requirements;

- Technical validation of the product including website, domain name, PO, system administration, risk-management, anti-fraud, KYC, AML processes;

- Implementation of Maltese regulatory requirements into your business model and your system (KYC, AML, thresholds for deposits, withdrawals, etc);

- A detailed business plan covering all of the above: business model, participants, and regulatory compliance in Malta;

Types of licenses

Malta licenses are divided into 4 types:

- Type 1 – for games that use a random number generator (RNG);

- Type 2 – for games where the outcome is determined by the outcome of an event (betting);

- Type 3 – for games that generate revenue from betting commissions or winnings (e.g. poker).

- Type 4 – for games where the outcome can be determined by collecting statistics(fantasy sports)

What’s interesting about the license:

The principal persons of the company, including directors, shareholders and AML officer must be approved by the MGA (Malta Gaming Authority); players’ funds must be kept separate from funds derived from operations; no local director is required; leasing a physical office in Malta is not required to obtain a gambling license. A registered address or office in the European Economic Area is sufficient.

Cost and Costs

B2C licensing

Type 1 – License for RNG games (casinos, slot machines, lotteries).

Minimum share capital – €100,000; annual license fee – €25,000; MGA license application fee (one-time) – €5,000.

Type 2 – License for games with events (sportsbook).

Minimum share capital €100,000; annual license fee €25,000; MGA license application fee (one-time) €5,000.

Type 3 – License for games that generate their commission income from bets or winnings (poker).

Minimum share capital €40,000; annual license fee €25,000; MGA license application fee (one-time) €5,000.

Type 4 – License for games of skill in which the result can be determined by the collection of statistics (fantasy sports).

Minimum share capital – €40,000; annual license fee – €10,000; MGA license application fee (one-time) – €5,000.

B2B licensing

There is a separate B2B license for businesses. It is specially designed for game and software creators.

In this case, game creators will pay:

- An annual license fee of €10,000.

- Depending on annual income:

- Up to €5,000,000 – €25,000;

- Up to €5,000,000 but less than €10,000,000 – €30,000;

- More than €10,000,000 – €35,000.

Software creators will pay:

- An annual license fee of €10,000.

- Depending on annual income:

- Up to €1,000,000 – €3,000;

- More than €1,000,000 – €5,000;

In case a company wants to work with different types of licenses, it must have a share capital of €240,000

Stages of licensure

Stage 1 – Eligibility Verification:

- Verification of all key persons, shareholder directors holding a 5% or more shareholding;

- Review of business plan and financial projections for 3 years;

- Web site text and content;

- Verification of technical documentation and system/operational controls.

Important At this stage, special attention will be paid specifically to your company’s AML officer, who should be listed as an authorized employee of your company.

Stage 2 – System Audit

- MGA authorization to implement the proposed infrastructure prior to operation;

- Implementation and system audit to be completed within 60 days of authorization;

- Issuance of a license for a period of 10 years;

- Compliance audit after the first year of operation.

The whole process of registration and obtaining a license takes about 6-7 months.

Malta taxation

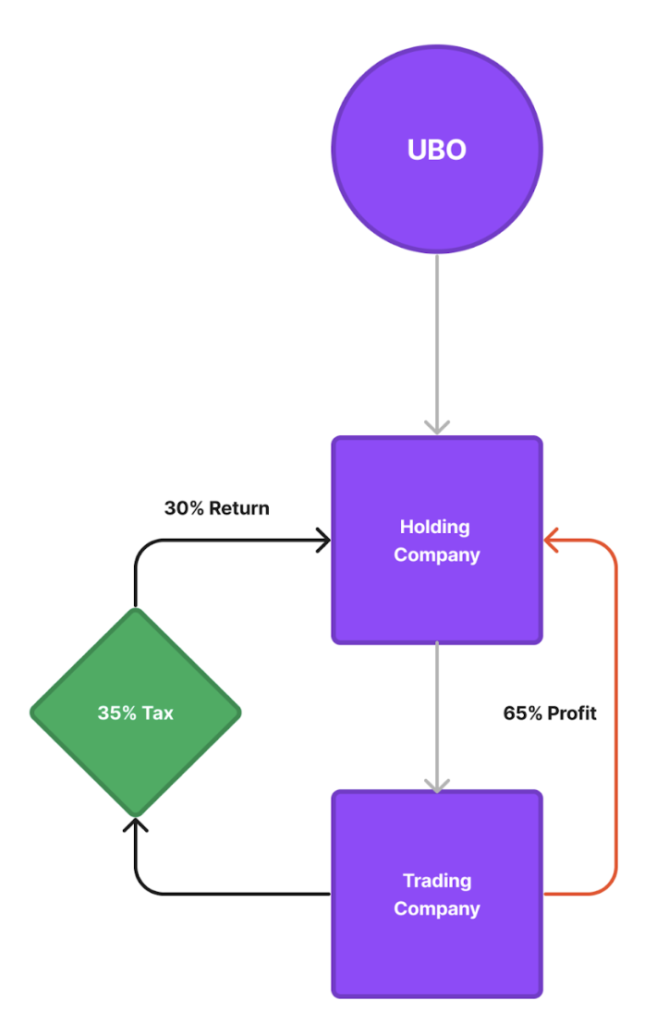

In Malta, corporate tax is set at 35%, deducted from profits (income minus expenses).

The tax is quite high, but there is a way to “reduce” it by using a “two-company” corporate structure.

In practice, it looks like this: a company that is licensed (let’s call it “Trade company”) is owned by another local company (we’ll call this one “Holding company”) and at the top is a physical person – the beneficiary.

The taxation system works in such a way that having two companies in the structure, the income of the Trade company will be due to the parent Holding company.

Accordingly, when distributing the profit of the parent company – it will be necessary to pay 35% of corporate tax, after which 30% will be returned to the Holding company as dividends. This structure allows to reduce the tax rate to 5%.

It should be separately emphasized that social contributions must be paid for the employed employees. For Malta this amount is approximately 200 euros. That is, for at least two mandatory employees (Director and AML officer) the company has to pay €400.

In addition, a GGR tax is additionally applied, which varies according to the turnover. There are different tax rates for different licenses.

For RNG games it is calculated as follows:

- Up to €3,000,000 – 1.25%;

- Up to €4,500,000 but more than the previous – 1%;

- Up to €5,000,000 but more than the previous – 0.85%;

- Up to €7,500,000 but more than the previous – 0.7%;

- Up to €10,000,000 but more than the previous – 0.55%;

- Anything over – 0.4%.

For games with events (sportsbook):

- Up to €3,000,000 – 3%;

Up to €4,500,000 but more than the previous – 2%;

Up to €5,000,000 but more than the previous – 1%;

Up to €7,500,000 but more than the previous – 0.8%;

Up to €10,000,000 but more than the previous – 0.6%;

Anything over – 0.4%.

For games that generate their commission income from bets or winnings:

- Up to €2,000,000 – 3%;

- Up to €3,000,000 but more than the previous – 2%;

- Up to €5,000,000 but more than the previous – 1%;

- Up to €6,000,000 but more than the previous – 1%;

- Up to €7,500,000 but more than the previous – 0.8%;

- Up to €10,000,000 but more than the previous – 0.6%;

- Anything over – 0.4%.

For games of skill:

- Up to €2,000,000 – 0.5%;

- Up to €3,000,000 but more than the previous – 0.75%;

- Up to €5,000,000 but more than the previous – 1%;

- Up to €6,000,000 but more than the previous – 1.25%;

- Up to €7,500,000 but more than the previous – 1.5%;

- Up to €10,000,000 but more than the previous €10,000,000 – 1.75%;

- Anything over – 2%.

Conclusion

Malta’s gambling license is recognized as one of the most prestigious in the iGaming industry, allows you to open more markets for your company, offers opportunities to avoid double taxation, and is very recognizable and reliable – it is trusted by operators and players alike.

Taxation is set up in a clear way, without unnecessary clutter and complications that would prevent businesses from calculating the exact amount of profitability. As a bonus, the final amount can also be reduced by using the method described above.

It is worth emphasizing that B2B business operators have rather soft business conditions, including (comparatively) low tax rates for game and software creators.

A Malta license can be an excellent solution for operators who wish to operate in the European market,

Publication content

More articles

Mon-Fri 10:00-19:00

Estonia

Harju maakond, Tallinn, Kesklinna linnaosa, Tuukri tn 19-315, 10152

Mon-Fri 10:00-19:00

United States

228 Park Ave S PMB 516920 New York, New York 10003-1502 US