How to obtain a Tobique gambling license?

Yulia Nazaruk

iGaming

Publication content

The license

The Tobique gambling license is an ideal alternative to the Curacao license. It provides the same advantages and allows you to operate all over the world, except for prohibited jurisdictions, but at the same time, it has fewer requirements than, for example, the Curacao license after the reform of the Curacao Ministry of Finance.

The process of obtaining a Tobacco gambling license is distinguished by its transparency and efficiency. The level of bureaucracy is minimal, which allows you to get a license within 2 weeks from the date of application. Unlike many other jurisdictions, Tobacco does not transfer any additional fees or taxes to the regulator – only an annual license fee, which makes this license affordable for startups.

The Tobacco license covers all gambling verticals, including online casinos, sports betting, bingo, table games, and other gambling activities. The only type of activity prohibited under this license is the organization of drawings with physical prizes.

The license is issued for 1 year and is renewed annually. The legislation does not provide for any restrictions on the number of online licenses that can be obtained per company. The license price covers two (2) URLs, but there is an option to purchase additional URLs for a fee. The Tobacco gambling license allows you to cooperate with the same game providers and connect the same payment solutions as the Anjou and Curacao licenses.

| License application fee | 36 000 EUR |

| Minimum authorized capital requirement | None |

| Requirement to hire resident employees | None |

| Requirement to have a local office | None |

Requirements for obtaining a license

- Confirmation of the impeccable reputation of all shareholders and the director of the company (no criminal record)

- Confirmation of the address of residence of all shareholders and the director of the company. A utility bill is usually sufficient to prove the address.

- Confirmation that the UBO has sufficient financial resources to conduct the gambling business (bank statement for the last three months);

- Confirmation of experience and qualifications in the online gambling industry (CV, letter of recommendation, etc. are acceptable);

- Developing and implementing responsible gambling policies and procedures (self-exclusion, cooling-off, the ability for players to set deposit limits, betting limits, gaming session limits, links to organizations that provide support for players with gambling addiction, such as omniahealthgroup.com);

- Availability of a functional website that meets the requirements after the licensing process.

The website must have a properly designed footer. In particular, it must contain the following:

- An active validator confirming the existence of a license,

- “About Us” section,

- Links to resources for responsible gambling,

- Information on complaints and dispute resolution,

- Contact Us section,

- Policies:

◻︎ Terms of Use

◻︎ Privacy Policy

◻︎ Bonus Policy

◻︎ Affiliates

◻︎ AML & KYC policy

The process of obtaining a license

An application for a license is submitted through an online portal by uploading the required documents. The regulator usually reviews the application within 2-3 weeks after preliminary approval, instead of 8-12 months, which is typical for many other licenses. However, under certain circumstances, this process can take up to 8 weeks.

To apply, you must make an upfront payment of EUR 2,500 (subsequently deducted from the license fee), which is non-refundable. The advance payment is not a guarantee of obtaining a license, however, in case of refusal, the payment may be partially refunded.

The process of obtaining a license consists of the following stages:

- Registration of a company

It is necessary to register a legal entity to conduct gambling business. The best option is a company in Costa Rica. - Preparation of documentation

It is necessary to collect all the necessary documentation, which includes:- a completed application for a gambling license

- business plan, charter and other corporate documents;

- a list of services and games to be offered;

- copies of personal documents of the founders and managers of the company;

- technical characteristics of the gambling platform.

- Submission of documents

It is necessary to submit documents to the TGC and pay the required application and licensing fees. - Due diligence by UBO and company directors

UBOs with a 10% or more shareholding will be required to undergo due diligence at the stage of obtaining a license. This includes confirmation of the SOW and SOF.SOW (Source of Wealth) provides for confirmation of the source of income of the UBO.

SOF (Source of Funds) provides for confirmation of the source of financing of the company.The following documents can be used to confirm the SOW and SOF:- Bank statement (for the last 3 months) confirming the source of your income;

- Tax return;

- Loan agreement;

- Legal/judicial documents on inheritance;

- A document confirming the sale of property (for example, a real estate purchase agreement), etc.

- Checking the application for compliance with local laws

The regulator will review your application to ensure that it complies with local law. For this purpose, the regulator may request additional documents. - Approval and issuance of the license

If your application is approved and your activities meet all the requirements, you will be issued a gambling license.

Prohibited and restricted territories

Prohibited jurisdictions

The Tobacco License does not allow you to operate in such jurisdictions as the United Kingdom, the United States, Ontario, and New Brunswick. It is also forbidden to offer and advertise your services in countries that are on the FATF blacklist and under sanctions: China, Cuba, Central African Republic, Democratic Republic of the Congo, Haiti, Iran, Iraq, Israel, Libya, Myanmar, North Korea, Russia, Somalia, South Sudan, Syria, United Kingdom, United States, Yemen, Venezuela, and the United States.

Payments

This license allows you to make and accept payments in most fiat currencies and cryptocurrencies.

License holders are obliged to geographically block consumers residing in the United States, the United Kingdom, New Brunswick, Ontario, countries that are subject to FATF sanctions, and are also obliged to block the registration of players from prohibited territories.

Corporate structure

To obtain a Tobacco gambling license, you do not need to register a local company, as, for example, to obtain a Curacao license.

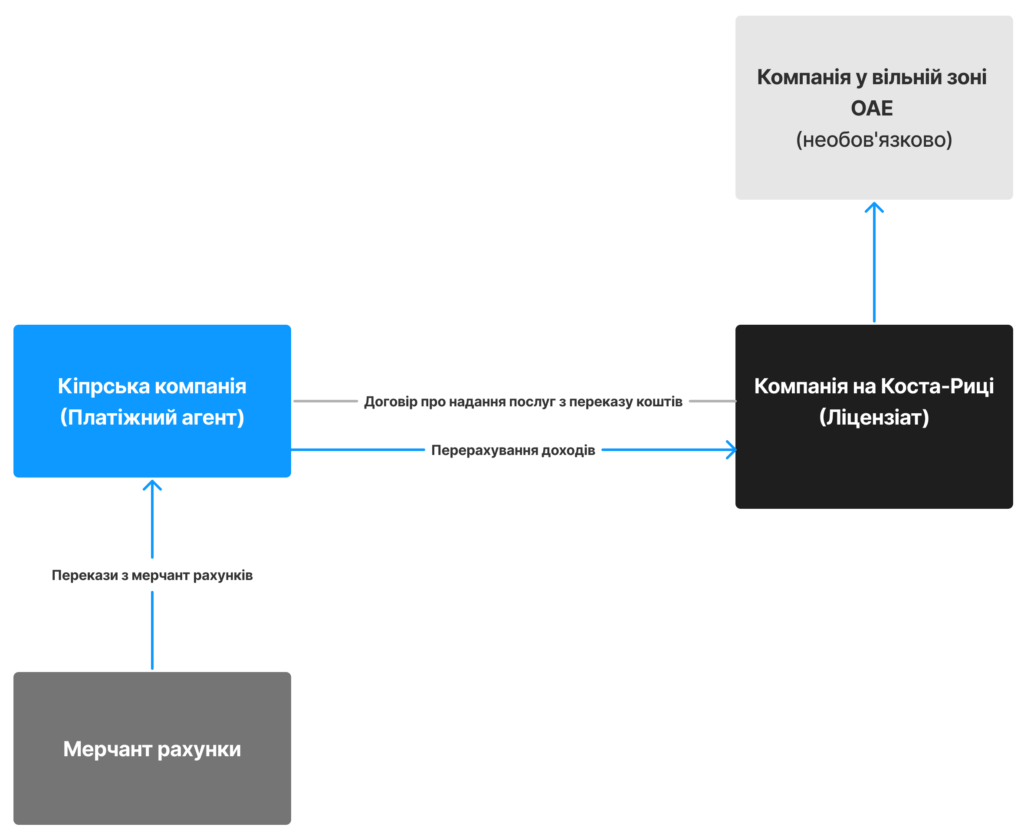

In principle, a Tobacco license can be obtained for a company registered in any jurisdiction, but the best option is a company in Costa Rica. Costa Rica is advantageous because the online gambling industry is not regulated there and there is no local license for online gambling. Since payment service providers and banks cannot directly interact with Costa Rica (or any other offshore jurisdiction), it is necessary to additionally register a company in Cyprus that will act as a payment agent and open bank and merchant accounts.

For tax optimization, registering a company in the UAE is also an advantageous, but optional, option, which will allow you to withdraw profits in fiat in the form of license fees. A company in the UAE owns property rights to certain intellectual property (e.g., trademark, software, etc.) and enters into a license agreement for such objects with a company in Costa Rica and receives license fees under the agreement.

Below is a schematic representation of the corporate structure:

Taxation

Costa Rica

According to the Costa Rican Income Tax Law, income from transactions carried out abroad is considered to be income earned outside of Costa Rica and is not subject to income tax. Costa Rican income tax is levied on income derived directly from business activities in Costa Rica.

The corporate income tax is 30%. However, the law establishes special rules for small companies whose gross income does not exceed 122,145,000 Costa Rican Colones (CRC) ($240,000). In this case, a progressive rate is applied:

| 5% | up to 5 761 000 CRC |

| 10% | 5 761 000 – 8 643 000 CRC |

| 15% | 8 643 000 – 11 524 000 CRC |

| 20% | 11 524 000 – 122 144 999 CRC |

| 30% | more than 122 145 000 CRC |

Cyprus

The above structure is very tax efficient. It is recommended that the paying agent company receives commercial remuneration for its role in the structure – usually a small percentage of the income received (for example, from the volume of financial transactions). For example, it can be 5%.

Corporate Income Tax (CIT) is paid on the income received (minus any expenses, such as accounting costs, rent, etc.). The current corporate tax rate in Cyprus is 12.5%.

For example, a Cyprus company has income of EUR 1,000,000 and withholds a commission of 5%:

| Income | 1 000 000 EUR |

| Expenses Fee and commission under the Money Transfer Agreement (95%) | 950 000 EUR |

| Administrative expenses | 35 000 EUR |

| Profit subject to taxation | 15 000 EUR |

| Amount of tax payable (12.5%) | 1 875 EUR |

| Amount of tax payable (12.5%) | 13 125 EUR |

The cost of the license

To obtain a license, you need to make 3 payments: a pre-application fee, an application fee, and an annual license fee:

| Pre-application fee | 2 500 EUR |

| Application fee for submission of the application | EUR 36,000 (EUR 33,500 after deduction of the preliminary application fee) |

| Annual license fee | 18 000 EUR |

Publication content

More articles

Mon-Fri 10:00-19:00

Estonia

Harju maakond, Tallinn, Kesklinna linnaosa, Tuukri tn 19-315, 10152

Mon-Fri 10:00-19:00

United States

228 Park Ave S PMB 516920 New York, New York 10003-1502 US